重視專業技能和知識。安融(香港)評級的信用分析師都持有大學學位,具有全球視野和公司治理 、財務 、風險管理 、行業特性和商業趨勢分析等豐富知識。 安融(香港)評級的分析師與他們在中國的同事在收集數據上協同合作,在香港進行獨立的信用和產業分析。

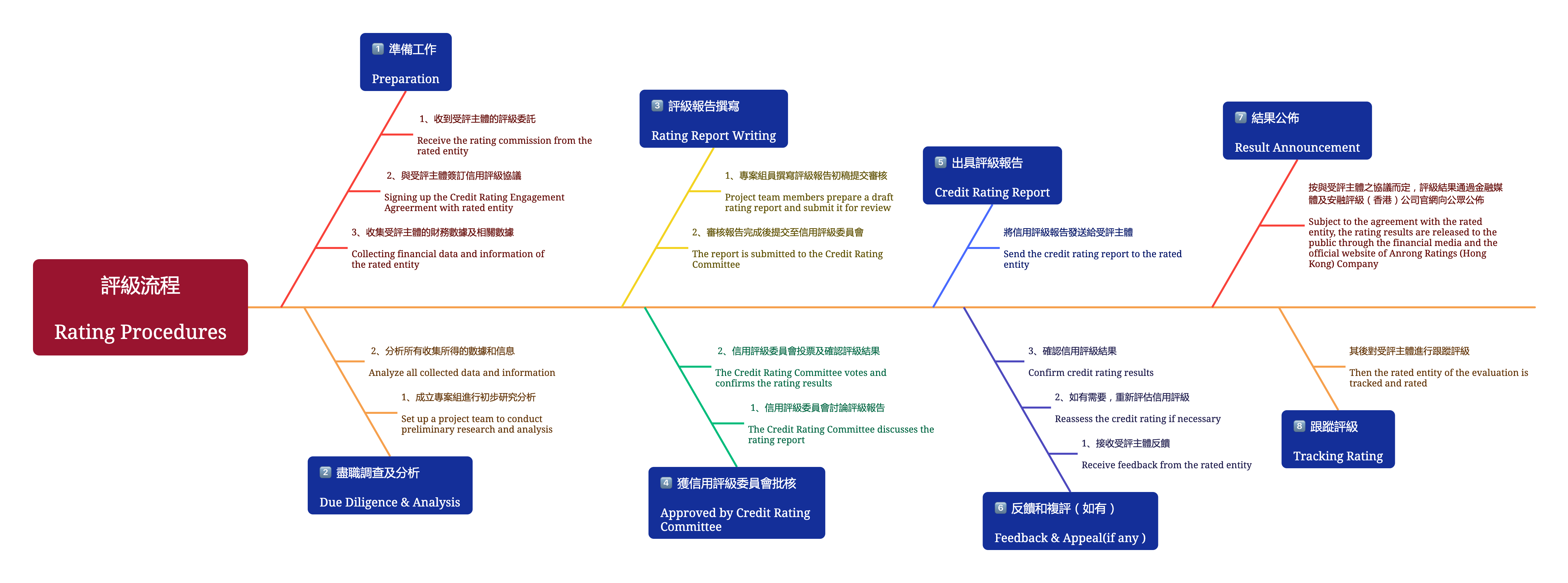

嚴格的審批過程:信用評級團隊提交信用評級報告給評級總監審核,然後提交信用評級委員會批核。最後通知受評主體信用評級結果。關於公開評級,如果受評體主體對評級結果沒有異議,信用評級結果將向公眾公佈。如果受評主體在安融(香港)評級向公眾公佈前不同意評級結果,可以提供額外的資訊予安融(香港)評級進行審查。如果安融(香港)評級管理層認為額外的資訊可能有足夠的理由來改變信用評級結果,信用評級委員會將審查最近的信用評級結果,而信用評級結果將可能保持不變或更改到一個新的結果。

關於公開和和私人委託評級, 安融(香港)評級在發出或修訂評級前,會將評級依據的關鍵資料及主要考慮因素告知獲評級實體,讓獲評級實體有機會澄清可能對事實的任何誤解或安融(香港)評級希望得悉的其他事宜,以便擬備準確的評級。安融(香港)評級會適當地評估其回應。如安融(香港)評級在特定情況下未能在發出或修訂評級前告知獲評級實體,安融(香港)評級其後會在切實可行的範圍內盡快告知獲評級實體,及一般而言應解釋延遲的原因。

Value on professional skills and knowledge: ARHK’s analysts are degree-holders and possess a global perspective and rich knowledge of corporate governance, finance, risk management, industry specifics, and business trend analytical skills. They collaborate with their colleagues in China in collecting data on rated entities and industries for their independent credit analysis carried out in Hong Kong.

Follow a rigorous approval process: The credit rating team submits the credit rating report to the rating director for vetting and quality evaluation. Upon endorsement of the credit rating report, it is then submitted to the credit rating committee for approval. The rated entity is then informed of the credit rating result. For public credit rating, if the rated entity has no objection to the result, the credit rating result will be announced publicly. Should the rated entity disagree with the rating result before public announcement, the rated entity is allowed to send additional information to ARHK for review of the credit rating result. If the credit rating team finds that the additional information may provide sufficient ground to change the credit rating result, the credit rating committee will be called for review and a final credit rating result will be concluded, which will either remain the same or be revised to reflect the new information.

For public solicited rating and private solicited rating, prior to issuing or revising a rating, ARHK informs the rated entity of the critical information and principal considerations upon which a rating will be based and allows the rated entity to clarify any likely factual misperceptions or other matters that it would wish to be made aware of to produce an accurate rating. ARHK will evaluate the response appropriately. In particular circumstances where it is not feasible to inform the rated entity prior to issuing or revising a rating, ARHK Credit Rating would inform the rated entity as soon as practical thereafter and, generally, would explain the reason for the delay.