Zhongcai–Anrong Institute for Local Fiscal Investment and Financing Visits Hong Kong and Shenzhen for Research

To gain an in-depth understanding of local government investment and financing under the new development paradigm—particularly the current situation, challenges, and innovative practices in cross-border financing and debt management—the Zhongcai–Anrong Institute for Local Fiscal Investment and Financing organized a special research delegation including Professor Wen Laicheng, Professor Li Yan, Professor Bai Yanfeng, Professor Jiang Aihua, Professor Ma Jinhua, Professor Yang Hua, Associate Professor Wang Wei, Chairman Zhou Yuanfan of the Board of Anrong Credit Ratings (Hong Kong) Co., Ltd., (ARHK) President Lu Dan of Anrong Credit Rating Co., Ltd., and others. From January 25 to 27, the group conducted a three-day in-depth research visit to the Hong Kong Special Administrative Region and Shenzhen, aiming to obtain cutting-edge developments and frontline insights through on-site visits to key market institutions and government departments. The delegation successively visited ARHK, Hong Kong Exchanges and Clearing Limited, Bank of Communications International Holdings Co., Ltd., Zhongtai International Securities Limited, the Shenzhen Municipal Finance Bureau, and the Shenzhen branch of Anrong Credit Rating Co., Ltd., covering the full chain from international credit assessment and capital market operations to cross-border investment banking services and local fiscal management. Research activities included attending thematic briefings, participating in roundtable discussions, and conducting in-depth interviews with business units. The team exchanged views on shared concerns with the key leaders and core staff of each institution and department. The itinerary was tight and the content substantial, achieving the expected research objectives. Anrong Rating Vice President and General Manager of the Hong Kong–Shenzhen headquarters Zeng Yingfeng, Assistant to the President and General Manager of the Shenzhen branch Zeng Zhengxin, Executive Director of ARHK Lam Yui Ying LYDIA, Vice President Tang Binyang, and others accompanied and participated in the research.

Research at Anrong (Hong Kong) Credit Rating Co., Ltd. (I)

Research at Anrong (Hong Kong) Credit Rating Co., Ltd. (II)

Research at Anrong (Hong Kong) Credit Rating Co., Ltd. (III)

Benefiting from a carefully organised and designed research route that covered different market participants—“market service institutions, capital operation platforms, funding and liquidity intermediaries, policy and management authorities”—this special research visit yielded rich outcomes and carried important significance on multiple levels.

The foremost gain was an effective grasp of the market frontier. The thematic briefing by Anrong (Hong Kong) Credit Ratings Co., Ltd., “Offshore Bonds of Urban Investment Platforms: Investors’ Opportunity Puzzle and Risk Balance under the Debt Resolution Backdrop,” precisely hit the focal concerns currently in the market. Through Q&A and discussion, the team came to a deep understanding that international investors’ evaluation logic for offshore bonds of urban investment platforms has undergone profound changes. Within the debt-resolution context, opportunities are increasingly skewed toward market-oriented operators with clear business-transformation paths and sustainable cash-flow capabilities. The research at HKEX enabled the team to systematically understand the bond listing mechanisms of the exchange as a global financing hub, providing a clear pathway for mainland entities to expand diversified offshore financing channels.

Research at Hong Kong Exchanges and Clearing Limited (I)

Research at Hong Kong Exchanges and Clearing Limited (II)

Research at Hong Kong Exchanges and Clearing Limited (III)

Exchanges with Bank of Communications International and Zhongtai International clearly demonstrated the cross-border comprehensive financial services capabilities of Chinese-funded financial institutions, which rely on the “commercial bank + investment bank” and “onshore + offshore” linkage models. They are not only financing channels, but also important bridges connecting domestic and international markets.

Research at Bank of Communications International (I)

Research at Bank of Communications International (II)

Research at Zhongtai International(I)

Research at Zhongtai International (II)

The coordinated research across Anrong Rating’s Hong Kong and Shenzhen operations provided a clear and compelling demonstration that credit rating agencies play an indispensable infrastructure role in financial market connectivity and interoperability within the Guangdong–Hong Kong–Macao Greater Bay Area. Notably, Anrong (Hong Kong), as Anrong Rating’s first overseas subsidiary, has formally obtained a Type 10 (providing credit rating services) financial license issued by the Hong Kong Securities and Futures Commission. This license not only permits it to conduct business in Hong Kong in compliance but also, because the SFC has signed memoranda of understanding with regulators in the EU, Singapore, Japan, and other jurisdictions, confers potential permission to operate in these important markets, thereby significantly enhancing its international business capabilities. This provides mainland urban investment enterprises with a more diversified range of rating services aligned with international standards when issuing bonds in Hong Kong.

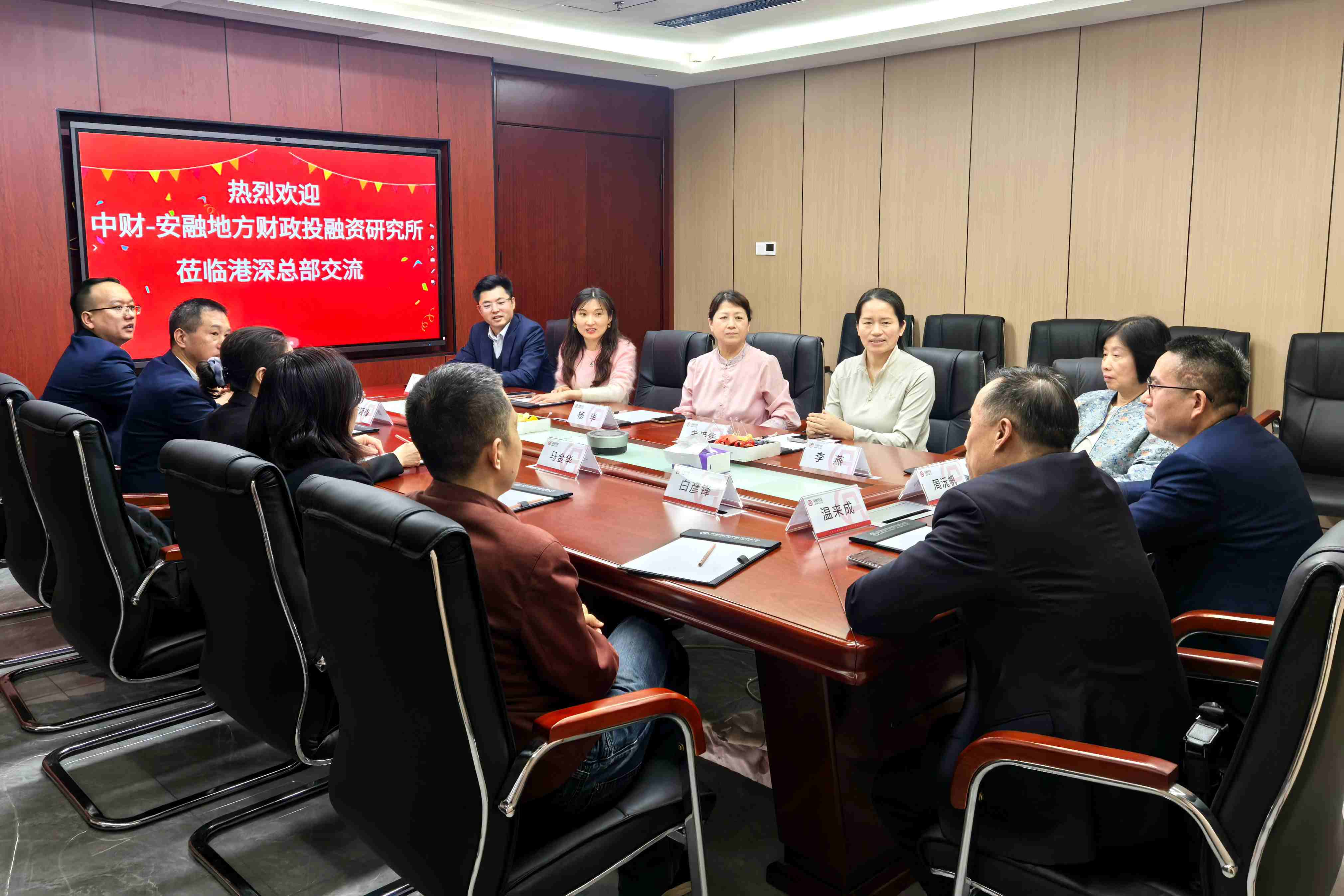

Research at Anrong Rating Shenzhen Branch

Another core gain of the research was understanding advanced practices and transformation directions in local fiscal management. The Shenzhen Municipal Finance Bureau shared its practices in refined, full-cycle management of government debt, standardised application of the PPP model, and the systematic cultivation of “20+8” industrial clusters through government investment guidance funds. These practices revealed a fundamental shift in the investment and financing functions of local governments in developed regions: from traditional “financing builders” to “risk managers” and “industry enablers.” Such innovative practices of “opening the front door, blocking the back door” and combining “guidance with constraints” provide a highly valuable sample for thinking about the sustainable development of local public finance nationwide.

Research at Shenzhen Municipal Finance Bureau (I)

Research at Shenzhen Municipal Finance Bureau (II)

The research found that, against the macro backdrop of balancing local government debt risk prevention and high-quality development, the market is showing several notable trends: First, the bond market function of Hong Kong as an international financial center is becoming increasingly prominent, and it is becoming a key hub for local governments and platform companies to expand diversified and internationalized financing channels; second, the cross-border collaborative service capabilities of Chinese-funded financial institutions have been substantially strengthened, and the “commercial bank + investment bank” and “onshore + offshore” linkage model has become an important engine for serving the real economy and local financing; third, debt management by local finance departments is deeply evolving toward “full-chain, refined, with equal emphasis on risk prevention and development promotion,” actively exploring the use of offshore markets and innovative tools to manage debt and guide industry. In the context of building a new development paradigm, connecting the onshore and offshore markets and coordinating the use of two kinds of resources has important practical significance for optimising local government financing structures, preventing and defusing debt risks, and supporting industrial upgrading.

This research visit carries important significance. At the theoretical level, it introduces vivid practical cases and real-world questions from the front line into academic research, thereby avoiding a disconnect between theoretical studies and market realities. At the policy level, the information and insights obtained can serve as decision-making references, based on frontline feedback, for relevant departments to optimise local government debt management and to standardise and encourage cross-border financing innovation. At the institutional development level, this research visit served as an academic practice activity. This research was not only an information-gathering exercise but also an enhancement of understanding, the building of networks, and the calibration of direction. It laid the groundwork for subsequent joint research, case development, and talent development.

Presenting a flower basket to the bronze statue of Comrade Deng Xiaoping, the chief architect of reform and opening up, at the Reform and Opening-up landmark in Shenzhen’s Lianhua Mountain